This example is typically referred to as remaining underwater, and it signifies that in the event you market your private home or are foreclosed on, you are going to successfully get nothing at all, because many of the equity will go to the lenders.

Impact on your credit history might fluctuate, as credit history scores are independently based on credit score bureaus depending on several aspects such as the economical decisions you make with other monetary products and services companies.

A secured loan ensures that the borrower has put up some asset as a method of collateral ahead of becoming granted a loan. The lender is issued a lien, which can be a right to possession of residence belonging to another individual until a personal debt is compensated. Put simply, defaulting on the secured loan will give the loan issuer the legal capability to seize the asset that was place up as collateral.

House loan charges and costs can differ extensively throughout lenders. That will help you locate the proper one for your requirements, use this Resource to match lenders based upon many different things.

Overall loan payments: The loan principal plus the full fascination Expense. This quantity doesn’t involve an origination price.

Should you’re attempting to market your present house though acquiring another a single, you'll be able to try a distinct system that works very equally to the piggyback loan. As opposed to receiving two mortgages on a completely new house, you usually takes out a loan secured by your recent household to go over all or Portion of the deposit on the new a single. After the sale goes via, you’ll be capable of use the proceeds to pay off the house-secured loan.

Borrowers with weak credit may possibly qualify for your lousy-credit history individual loan, even so, you can transform your probability of qualifying and reduce your rate by getting a joint, co-signed or secured particular loan.

Now you've got two house loan payments to produce each month, but you’ve bought $100k within the bank. As well as your reduced-level very first house loan remains Tremendous cheap.

The word "loan" will most likely consult with this sort in day to day dialogue, not the sort in the next or third calculation. Underneath are backlinks to calculators associated with loans that fall beneath this group, which can offer more details or permit unique calculations involving Just about every sort of loan. Instead 20 80 loan of working with this Loan Calculator, it may be a lot more beneficial to make use of any of the next for every particular need:

To prevent mortgage insurance policies. As we lined previously, you are able to leverage a piggyback loan to prevent paying for PMI if you’re Placing down a lot less than twenty% on a conventional loan.

Any time you submit an application for home loans, you'll have to spend closing prices for both equally mortgages. This may raise the total cost of the loan considerably, reducing into possible money Positive aspects.

An eighty/ten/10 piggyback loan is actually a variety of loan that involves having two mortgages at the same time: One particular is for eighty per cent of the house’s benefit and the opposite is for ten %. The piggyback approach permits you to keep away from non-public home loan insurance coverage or needing to acquire out a jumbo loan. Homeowners purchasing a whole new position can adopt a variation around the piggyback technique: employing a dwelling fairness loan or credit rating line for the second, smaller sized mortgage.

Review interest prices, APRs, charges and loan terms among many lenders to view which choice satisfies your needs and gives you the most beneficial deal.

APR: The annual proportion level may be the curiosity fee with the origination charge involved. Devoid of an origination fee, the curiosity price equals the APR.

Tony Danza Then & Now!

Tony Danza Then & Now! Dylan and Cole Sprouse Then & Now!

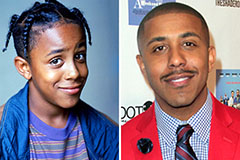

Dylan and Cole Sprouse Then & Now! Marques Houston Then & Now!

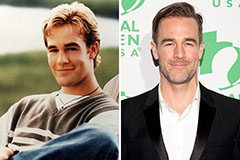

Marques Houston Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!